Understanding the Basics of Stock Investing

Introduction to Stock Investing

Investing in stocks can be a great way to build wealth and secure your financial future.

However, before diving into the world of stock investing, it's important to understand the basics.

Stock investing involves buying ownership shares of publicly-traded companies.

When you invest in a stock, you become a shareholder and have a stake in the company's success.

The goal is to buy stocks that will increase in value over time, allowing you to sell them at a profit.

To start investing in stocks in Canada, you'll need to open a brokerage account.

This will give you access to the stock market and allow you to buy and sell stocks.

It's important to research and choose a reputable brokerage that aligns with your investment goals and offers competitive fees.

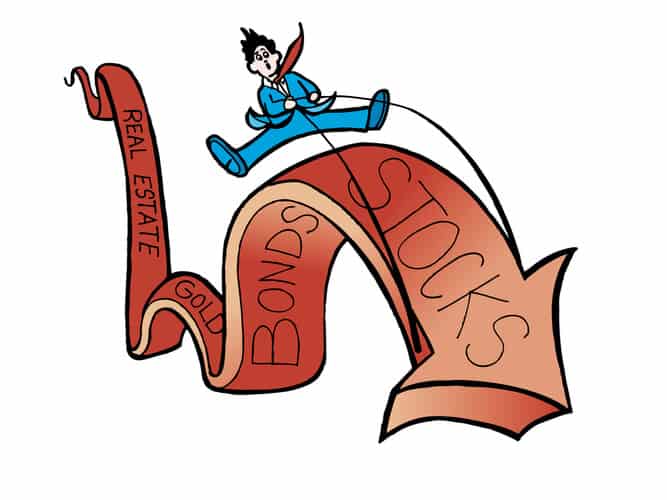

Benefits and Risks of Stock Investing

Stock investing offers several benefits, including the potential for high returns. Historically, stocks have outperformed other asset classes over the long term.

By investing in well-established companies with strong growth potential, you can capitalize on this.

However, stock investing also comes with risks.

Stock prices can be volatile and subject to market forces, economic conditions, and company-specific factors.

It's important to diversify your portfolio by investing in different sectors and companies to mitigate risk.

Additionally, it's crucial to conduct thorough research and analysis before making any investment decisions.

Overall, stock investing can be rewarding, but it requires patience, knowledge, and a long-term perspective.

By understanding the basics and managing risks effectively, you can navigate the stock market and potentially achieve financial success.

Getting Started with Stock Investing in Canada

Investing in stocks can be a lucrative way to grow your wealth and secure your financial future. If you're interested in starting your stock investing journey in Canada, here are some key points to consider:

Researching Canadian Stock Market

Before diving into stock investing, it's crucial to research and understand the Canadian stock market.

Familiarize yourself with the different sectors, companies, and market trends.

Stay updated on current events and economic conditions that can influence stock prices.

This knowledge will help you make informed investment decisions.

Choosing a Brokerage Account in Canada

To invest in stocks in Canada, you'll need to open a brokerage account.

Take the time to research and choose a reputable brokerage that aligns with your investment goals.

Consider factors such as fees, trading platform, customer service, and research tools offered by different brokerages.

Look for competitive commission rates and user-friendly platforms that suit your needs.

Start by investing smaller amounts and gradually increase your portfolio as you gain experience and confidence in the stock market.

Remember to diversify your investments across different sectors and companies to mitigate risks.

Lastly, stay updated on market news and educate yourself continuously to make informed decisions and capitalize on opportunities.

How to Choose Stocks for Investment

If you are considering starting your stock investing journey in Canada, here are some key points to help you choose the right stocks for investment.

Analyzing Company Financials

One important factor to consider when choosing stocks is analyzing the financials of the company you are interested in. Look at key metrics such as revenue growth, earnings per share, and profit margins. Assess the company's balance sheet to determine its financial stability and debt levels. By evaluating these financial indicators, you can gain valuable insights into the company's performance and make informed investment decisions.

Evaluating Industry and Market Trends

Another crucial aspect to consider is evaluating industry and market trends.

Stay updated on the latest news and developments in the sectors you are interested in investing in.

Look for industries with strong growth potential and positive market trends. Consider factors such as technological advancements, regulatory changes, and consumer behavior that can impact the industry's future growth.

By identifying industries with favorable market conditions, you can increase your chances of selecting stocks that have the potential for long-term growth.

Remember, investing in stocks involves risks, and it is essential to conduct thorough research and seek professional advice before making any investment decisions

Building a Diversified Stock Portfolio

Investing in stocks can be an excellent way to grow your wealth, but it's essential to approach it with a strategy.

One key aspect of successful investing is building a diversified stock portfolio.

Here, we will discuss the importance of diversification and how you can build a balanced portfolio with Canadian stocks.

Introduction to Diversification

Diversification is a risk management strategy that involves spreading your investments across different types of assets, industries, and geographical regions. By diversifying your portfolio, you can reduce the impact of any single investment's performance on your overall returns. This approach helps to protect your investments and potentially enhance long-term growth.

Building a Balanced Portfolio with Canadian Stocks

When it comes to investing in Canadian stocks, here are some key points to consider for building a balanced portfolio:

-

Research and Analysis: Start by researching different industries and companies in Canada. Understand the fundamentals of the companies you are interested in, such as their financials, growth potential, and market trends.

-

Asset Allocation: Determine the percentage of your portfolio that you want to allocate to Canadian stocks. Consider your risk tolerance, investment goals, and time horizon while making this decision.

-

Industry Diversity: Spread your investments across various industries to reduce sector-specific risks. Consider sectors that have a good track record, such as technology, healthcare, finance, and energy.

-

Company Size: Include stocks of companies of different sizes - large-cap, mid-cap, and small-cap. This diversification by market capitalization can help balance risk and potentially increase returns.

-

Geographic Exposure: Consider including stocks of Canadian companies that have international operations. This diversification can help mitigate the impact of regional or domestic fluctuations.

-

Review and Rebalance: Regularly review your portfolio's performance and make necessary adjustments. Rebalance your holdings to maintain the desired allocation and address any shifts in market conditions.

Remember, investing in stocks involves risks, and it is essential to conduct thorough research, stay informed about market trends, and consider professional advice before making any investment decisions.

Tips for Successful Stock Investing

Setting Realistic Goals

When starting to invest in stocks in Canada, it is crucial to set realistic goals. Determine what you aim to achieve financially and establish a timeline for your investments. This will help you stay focused and motivated, especially during market fluctuations. Whether you are investing for retirement, saving for a specific goal, or generating passive income, having clear goals will guide your investment decisions.

Comments

Post a Comment